Financial System

The product has a full featured accounting/financial system included. This portion of the system helps manufacturers maintain control of the financial aspects of the transactions from other parts of the application.

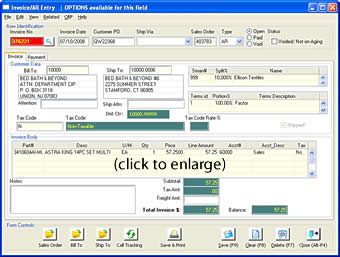

Accounts Receivable:

Accounts Receivable:

This portion of the system provides the manufacturer the ability to create and edit invoices from Sales Orders, enter and update Customer information and contacts, manage credit limits and removing customers from credit holds and viewing reports to manage the receivables process.

Key Features

- Use the batch Invoicer process to generate invoices for all shipments for the day.

- Able to override in Edit Invoice mode or to enter manual invoices

- Pulls data from Sales Order and Shipment record

- View Payment history from the AR form.

- Check Credit status

- Aging Reports

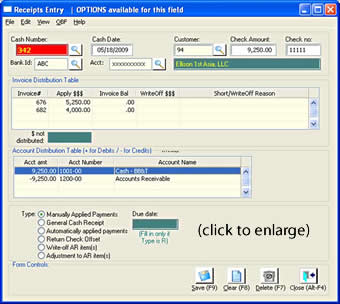

Cash Receipts:

Cash Receipts:

Receiving payments from customers and applying properly to outstanding invoices is a requirement for managing your cash properly. The Cash Receipts portion allows you to easily locate open invoices and apply payments to single or multiple invoices at a time. You can also enter and document short pays and write offs at the same time, if needed.

Key Features

- Separate module to track cash receipts and posting

- Intuitive data entry – enter check number and amount, system locates outstanding AR to apply cash to.

- Can apply cash multiple times to an invoice

- Creates Cash Receipts journals

- Multiple Banks and Accounts supported

- Deposits Aggregated from Receipts

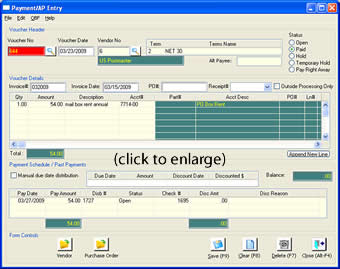

Accounts Payable:

This portion of the system allows your accounting department to manage the outflow of your cash. Payables are entered as Vouchers that can be linked to your Purchase Orders. It is recommended that all purchases be assigned Purchase Orders in order to completely track the outflow of resources so that there is documentation for the purpose and who authorizes the purchase. You will be able to match receipts to vendor invoices so that you have the audit trail verifying the purpose.

This portion of the system allows your accounting department to manage the outflow of your cash. Payables are entered as Vouchers that can be linked to your Purchase Orders. It is recommended that all purchases be assigned Purchase Orders in order to completely track the outflow of resources so that there is documentation for the purpose and who authorizes the purchase. You will be able to match receipts to vendor invoices so that you have the audit trail verifying the purpose.

The system will calculate payment dates based on the invoice date, date entered and your terms with the vendor. You may also override the calculation on an as needed basis in order to expedite payments when necessary. The system also provides a method to handle recurring payments such as rent, and to enter vendor invoices for normal operation such as utility bills.

Key Features

- Enter Vendor Invoices via Voucher form

- System calculates pay date based on invoice date and terms

- Enter Vendor Invoice Number and Date

- Enter PO Number or Receipt Number and system will pull in line detail

- Assign Accounts on a per line basis – easy lookup via double click or F12 Option

- View Past Payment on Vendor Invoice quickly

- Aging Reports

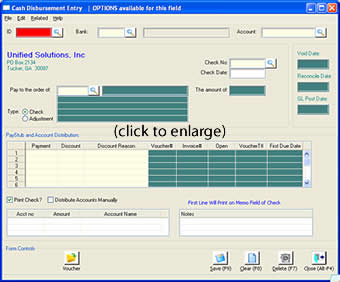

Cash Disbursements:

Cash Disbursements:

Checks should only be written when the proper approvals are met and the invoice is due. The system will check the status of the voucher and due dates and amounts. You may override these if the check is to be processed anyway. The Cash Disbursement system allow for cutting checks from multiple banks and/or accounts, and for checks to be top/bottom/middle. There is a lot of flexibility yet lots of control.

Key Features

- Choose bank and account to pay from – defaults to bank info from Company defaults

- Easy data entry

- Print Individual checks or batch mode.

- Easily Reconcile disbursements

- Set payable status – open/closed/hold/temporary hold/pay immediately

- Checks can be top/middle/bottom and defined in company defaults

- Void Open Checks

Bank Accounts:

The system has been developed with the ability to define multiple bank accounts. This provides flexibility in operations since most businesses have more than one account – perhaps an Operating Account, and an Investment/Money Market Account. And it is quite possible that the accounts can be a different financial institutions – be it the local bank or and investment firm.

The system has been developed with the ability to define multiple bank accounts. This provides flexibility in operations since most businesses have more than one account – perhaps an Operating Account, and an Investment/Money Market Account. And it is quite possible that the accounts can be a different financial institutions – be it the local bank or and investment firm.

Key Features

- Enter Banks where accounts reside and contact information

- Enter multiple Accounts per Bank

- Assign default Operating Account

- Tracks last check number used

Tax Authorities:

Taxes are getting more complex not simpler. The system provides for a way to handle taxes for almost all but the most complex municipalities. You can enter all your various taxing entities, state, local, county, and schools. And individual rates can be assigned to each, and assigned to the overall tax authority. This also lets you run reports by tax code to see how much is owed or paid.

Key Features

- Enter details for taxing authorities – state, local, school, homestead, etc.

- Enter rates for taxes

- Combine to get complete flexibility for tax for each state.

Terms:

The terms that you provide to your customer are very important in your cash management. The system allows you to define credit terms in a wide manner of ways – the standard ‘Net 10’ to various discounts based on days paid. This provides you the flexibility to meet your customer needs and well as keeping you in control. The terms can also be used to enter your terms with your vendors.

Key Features

- Pay terms easily defined and setup

- Handles net days, discount days, percents

- Use for Vendors and for Customer

General Ledger:

The General Ledger is the glue to hold the system together. The Chart of Accounts can be entered to best meet your needs and can handle many segments and formats as well as lengths. The financial statements can be configured to your specifications – and can be generated by the system or export to Excel where you have complete control of how you want the data to be displayed.

The General Ledger is the glue to hold the system together. The Chart of Accounts can be entered to best meet your needs and can handle many segments and formats as well as lengths. The financial statements can be configured to your specifications – and can be generated by the system or export to Excel where you have complete control of how you want the data to be displayed.

If you use and are proficient, access by Crystal Reports can be provided for financial reporting needs.

Key Features

- Enter GL Codes easily – open format to allow sub accounts and multiple segments

- Length of Code can be over 30 if needed

- View GL Detail easily

- Enter GL Journal quickly

- Recurring Journal Entries easy to setup and reverse

- Multiple Period Processing

- Multi-Company setup

- Print Trial Balance

- Financial Statement flexibility – print or export to Excel or similar spreadsheet

- Define Sum Accounts

Budgeting:

In smaller business budgeting is rarely used. As you grow, the system will allow you to enter budget amounts by your Chart of Accounts. This will then allow you to see how well you performed versus your plan entered at the beginning of the year.

Key Features

- Enter budget amounts by GL code for fiscal periods

- Flexible viewing

Year End Processing

Closing out a year can be an adventure in many systems. We have chosen to keep our processes simple and easily followed. The process will close out any annual accounts and roll-up summaries for the start of the new fiscal year.

- Follows a simple end of year step by step process to close the year

- Keeps transactions for years

- Allows for easily re-generation of prior period details and reports

Next: Stock Room Processing ->

Please contact us for further information or a demo.

OpenInsight is a trademarked product of Revelation Software,

Westwood, NJ

e-Insight ERP licensed from InsiTech Group LLC. Cheshire, CT.